Last modified: March 10, 2025

US dispensaries: Navigating your financial reports and 1099-K for tax purposes

Looking to learn more about finances and taxes?

Join a Customer Success rep in a group demo setting to gain a clear understanding of financial reporting and some of the tax implications related to sales made through your Fullscript account (relevant to US providers only).This article is intended for practitioners who received Form 1099-K from Fullscript. We suggest referring to US dispensaries: Reporting your income for tax purposes if you didn’t qualify for this form during the tax year.

Form 1099-K eligibility

We’re required to issue Form 1099-K (for 2024) if you had $5,000 USD in sales (i.e., gross payments) during the calendar year.

State-specific thresholds

Depending on individual state requirements, you may receive a separate state 1099-K.

If you’re located in the District of Columbia, Maryland, Massachusetts, Montana, North Carolina, Vermont, or Virginia, you’ll be issued a 1099-K if $600 or more in sales (i.e., gross payments) were transacted through your dispensary during the calendar year.

If located in New Jersey, you’ll be issued a 1099-K if you’ve transacted $1,000 or more in sales during the calendar year.

If you’re located in Illinois, you’ll be issued a 1099-K if you’ve transacted $1,000 or more in sales, from at least 4 unique transactions.

In Arkansas, you’ll be issued a 1099-K if you’ve transacted $2,500 or more in sales during the calendar year.

In Rhode Island, you’ll be issued a 1099-K if you’ve transacted $100 or more in sales during the calendar year.

Receiving your Form 1099-K

Near the end of the tax year, we may contact account holders to request missing information or confirm the information we have on file is correct. You can review and update your mailing address and other tax information from the Business financials page in your account. We recommend keeping this information current to avoid delays in receiving your 1099-K.

If you’re eligible for Form 1099-K, your form will be mailed to the mailing address provided (unless you’ve opted for E-delivery) and generated using the tax information we have on file.

Important figures in your financial reports

Gross amount transacted (1099-K amount)

This is your Fullscript sales total with expenses included. Fullscript is required to report the gross amount transacted through your account to the IRS if you meet the eligibility thresholds in your region. The gross amount is the amount presented on your 1099-K.

The IRS states that the gross amount transacted is “the total unadjusted dollar amount of aggregate payment transactions for each participating payee. This amount is not to be adjusted to account for any fees, refunds, or any other amounts.”

Sales Total

Sales Total represents the total retail value of orders transacted through the account, excluding expenses. This amount is found in the Account activity and balance report.

Net income

Fullscript net income is your Sales Total less Cost of Sales (Cost of Goods). This figure is calculated in your 1099-K Export and Account activity and balance report.

Expenses

These are the fees charged by Fullscript. Fees include (not a complete list):

- Fullscript processing fees

- Costs of goods

- Shipping charges

- Sales Taxes

- Refunded charges

- All adjustments (if any)

The IRS states that separate reporting of these transactions is not required. However, Form 1099-K can be used in conjunction with your other Fullscript reports and any other tax records related to your business to report your income.

1099-K export report

Those eligible to receive Form 1099-K should refer to the 1099-K Export available in your account on the Reports page. This report lists each sale by order number and applicable amounts, including the dollar amount the order has contributed to your 1099-K amount.

This report doesn’t replace Form 1099-K but does state your gross amount transacted through Fullscript (1099-K amount). We recommend you download and share this report with your tax professional, along with your 1099-K.

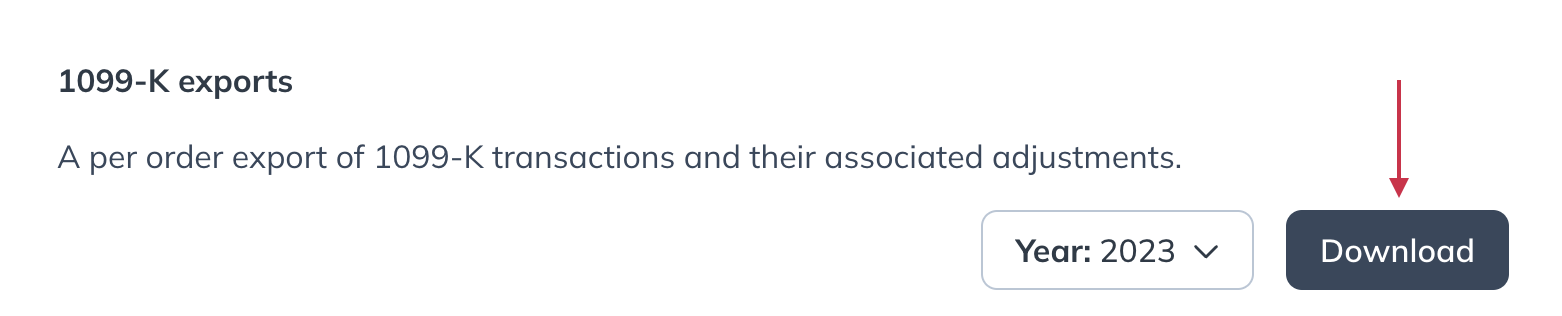

To download this report from your account:

- Log in to your account and go to Financial reports.

- Scroll down to the 1099-K Export header.

- Select the tax year to export the report.

Downloading the 1099-K Export from the Reports page.

Sample 1099-K export report

| Column/term | Definition | Column ID |

|---|---|---|

| 1099-K amount | Gross/total dollar amount of payment card transactions through the Fullscript account during the tax year. | [A] |

| Fullscript fees | These are the fees charged by Fullscript. | [B] |

| Fullscript gross income | 1099-K amount [A] less Fullscript Fees [B]. | [C] |

| Refunded payments | Amounts refunded. | [D] |

| FS fees refunded | Fullscript fees refunded in association with refunded payments. | [E] |

| Refunded income | Refunded payments [D] less Fullscript fees refunded [D]. | [F] |

| Fullscript net income | Gross income [C] less refunded income [F]. | [G] |

Account activity and balance report

The 1099-K Export can be used in conjunction with the Account activity and balance report to determine your proper earnings for tax purposes.

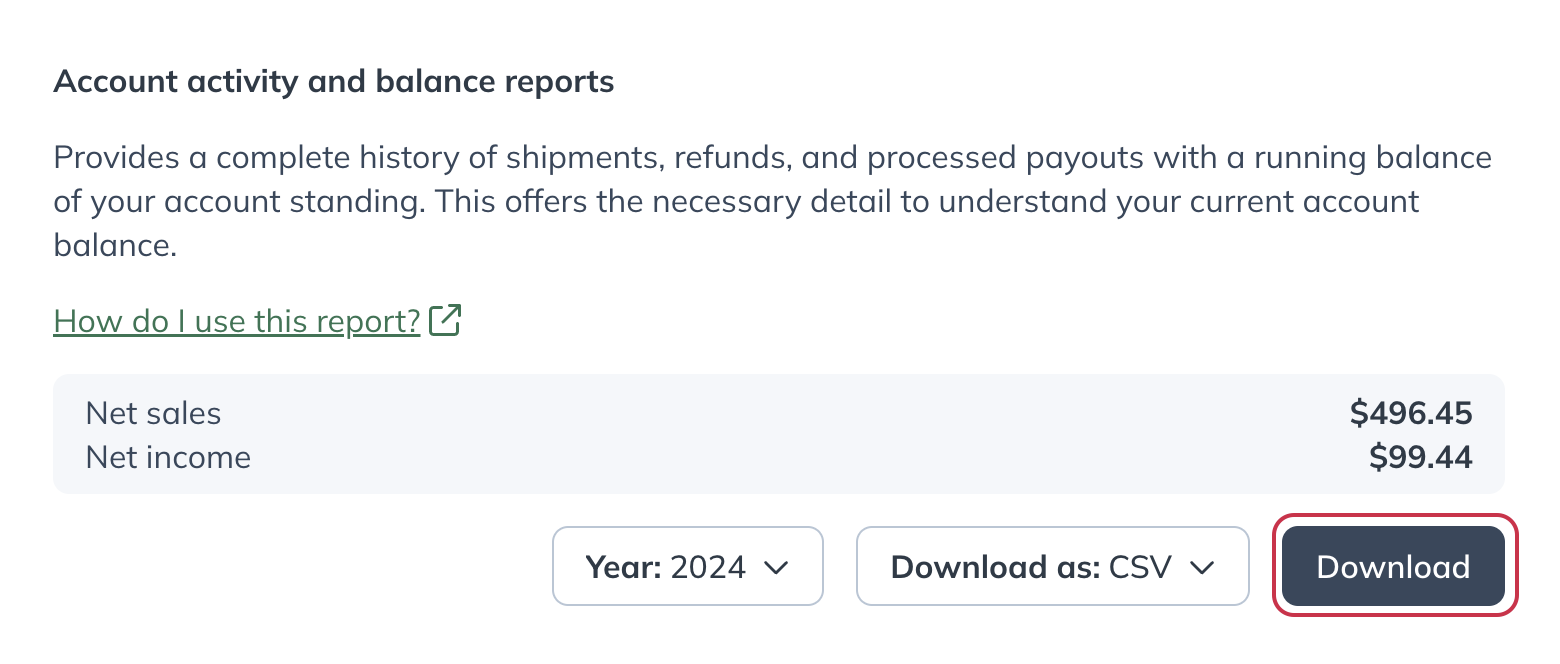

To download the Account activity and balance report:

- Log in to your account and go to Reports.

- Scroll down to the Account activity and balance report header.

- Select a tax year and a format.

- Click Download to download a formatted version of the report.

Sales tax

Fullscript operates as a Marketplace Facilitator whom is required to collect and remit sales tax on behalf of all Marketplace Sellers. Fullscript stores are considered Marketplace sellers.

Fullscript will remit any sales tax collected to the appropriate taxing authorities. Your business may still have sales tax/other tax obligations to fulfill. Your accountant or CPA can assist you in determining what your business obligations are.

Frequently asked questions

In this section:

Why did I receive a 1099-K?

Why is my Fullscript 1099-K reporting a number higher than what I actually earned?

What should I share with my tax professional relating to my Fullscript dispensary?

Why don’t the net income amounts on the 1099-K export and the Account activity and balance reports match?

Why am I receiving a 1099-K and not a 1099-Misc?

Have 1099-K thresholds changed for the 2024 tax year?

Why did I receive a 1099-K?

You’ll receive a 1099-K if you satisfy the eligibility requirements of your state.

Dispensary owners can reach out to our Customer Success team to request a PDF copy of their 1099-K, but keep in mind that 1099-Ks for the current tax year are not issued until January of the following year.

Why is my Fullscript 1099-K reporting a number higher than what I actually earned?

Don’t worry, this is normal and required. As per IRS 1099-K instructions, we’re required to report the gross amount of payments transacted on your account as opposed to your net earnings/income.

Gross Amount Transacted consists of:

- Fullscript processing fees*

- Cost of sales/goods

- Refunded charges

- All adjustments (if any)

*All sales tax and shipping charges are included in the fees charged to you by Fullscript.

What should I share with my tax professional relating to my Fullscript dispensary?

✔ Form 1099-K issued by Fullscript (if eligible)

✔ Account activity & balance report (for the tax year)

Why don’t the net income amounts on the 1099-K export and Account activity and balance reports match?

The net income on the 1099-K export report is based on the transaction date, while the account activity and balance report net income is based on order completion (i.e., the date the order shipped).

The 1099-K amount, as required by the IRS, must reflect the unadjusted dollar amount transacted within the year. For this reason, transactions in this report, and in turn, the resulting net income amount, consist of transactions that were processed within the reporting year (i.e., transaction date).

The account activity and balance report was designed to report all completed transactions processed through an account, where complete reflects the order has been fulfilled (i.e., the ship date).

Due to these timing differences, sales activity spanning multiple reporting years will impact net income across these reports.

For example, an order is placed 12/31/2020 and ships 1/3/2021:

- 1099-K export report: net income is reflected in the 2020 report, the year the order was transacted.

- AABR: net income is reported in 2021, the year the order shipped.

Why am I receiving a 1099-K and not a 1099-Misc?

Fullscript is legally a Third-Party Settlement Organization (TPSO), meaning we facilitate your patient’s orders by administering the transaction and organizing the delivery of products at the price you selected.

Form 1099-K is typically reserved for electronic payments and payments by credit card to contractors. If a company is deemed a payment settlement entity (PSE), it is required to file a 1099-K form.

The TPSO is:

- The establishment of accounts by a significant number of unrelated parties.

- An agreement between the organization and the sellers to settle payment transactions.

- The establishment of standards and mechanisms for settling the transactions.

- The organization’s guarantee that the provider will be paid.

Have 1099-K thresholds changed for the 2024 tax year?

Prior to calendar year 2024, the 1099-K threshold applied to accounts based in the U.S. with a total gross volume of $20,000 USD and 200 transactions. The IRS has reduced the threshold for the 2024 tax year.