Last modified: February 28, 2025

Tax exemption for wholesale purchases

Practitioners

Resale certification & eligibility

Fullscript will not collect sales tax for wholesale orders where a valid resale certificate matching the state the order is shipping to has been provided.

This guide provides steps to submitting tax exemption requests to Fullscript using a secure web portal, CertExpress. In addition to expiry reminders, this service simplifies tax exemption with up-to-date state forms and multi-jurisdiction submission support directly from your Fullscript account.

Submitting tax exemption requests

Being granted tax exemption is a three-part process: gaining access to CertExpress, submitting the exemption request, and the review/approval of the request.

Accessing CertExpress

To generate a link to access CertExpress:

- Go to Wholesale policies. To get here any time, click on your avatar or initials to expand the avatar menu, then select Wholesale policies. On mobile devices, tap the menu icon ( ), your name, then Wholesale policies.

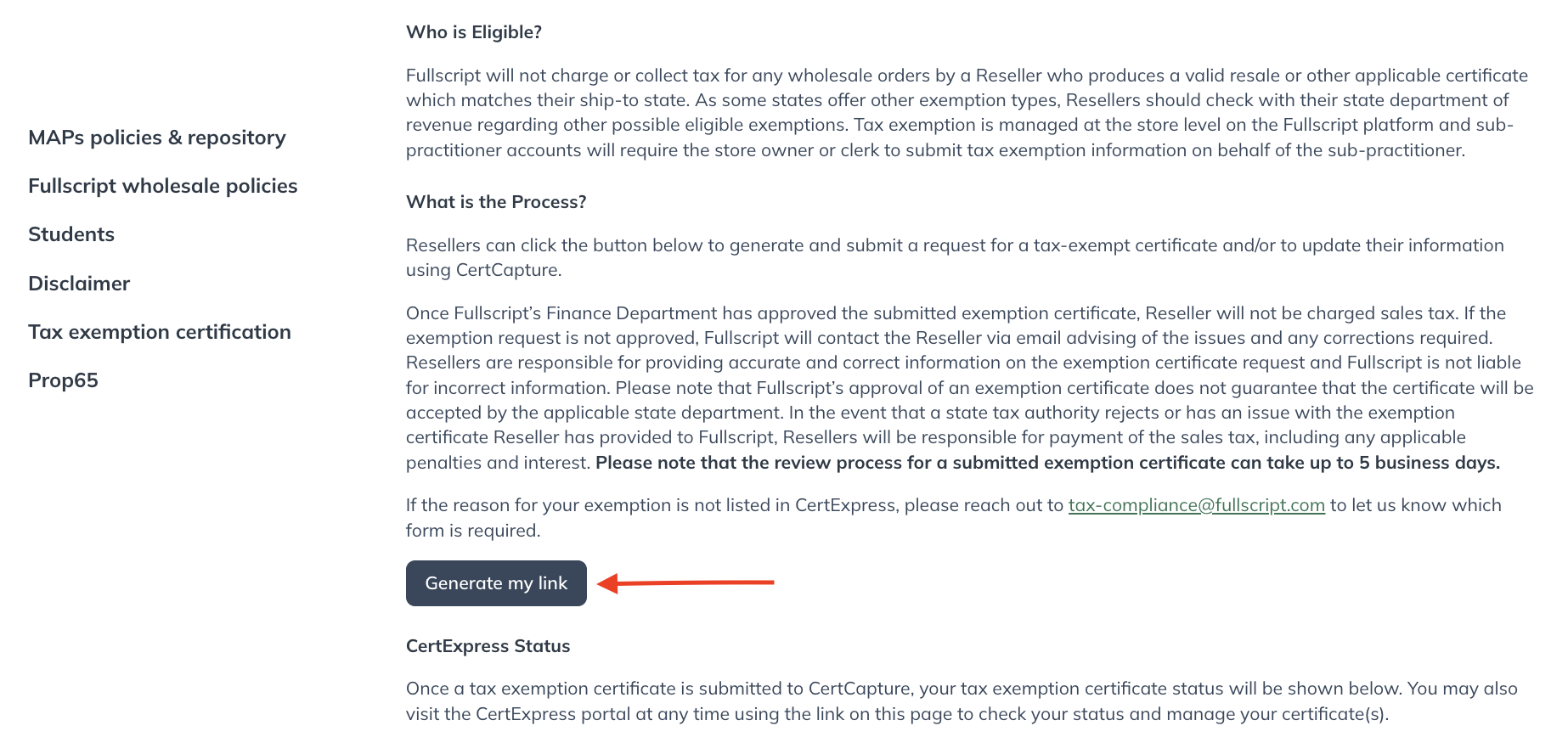

- Scroll down to Tax Exemption Certification.

- Select Generate my link.

- When your link generates, select Go to Avalara. You’ll be taken to CertExpress in a new tab to complete your exemption request.

Submitting an exemption request

Tax exemption requests are submitted in CertExpress. It may take up to 5 business days for our Finance team to review and approve submissions.

To submit a tax exemption request in CertExpress:

- Review and accept the terms and conditions to access CertExpress.

- Select + Add an exemption certificate

- From the State or Territory menu, select the first ship-to state you’re claiming an exemption for. This selection will determine which information you will need to provide to complete the document.

- For Reason, select Resale.

- Click Next.

- Complete the required fields. These fields may vary by document, which is based on the state selected in an earlier step.

- Click Next.

- Enter your name, title (i.e., Dr., Ms., Mr, etc.) and provide your digital signature. To sign, place your cursor in the box then click, hold, and drag to draw on the page.

- Select Next to submit your form.

Multi-jurisdiction submissions

The US MTC Uniform Sales & Use Tax Exemption/Resale certificate – Multijurisdiction document is a blanket resale certificate covering a number of states. When presented with this document, users can select all states where a resale certificate is held to submit multiple requests simultaneously. A permit or ID number will be required for each state selected.

When completed, the Wholesale policies page in Fullscript will show your exemption status for each state and permit/ID number entered. It may take a few minutes for submissions to reflect in your account.

Exemption review & statuses

When your document is submitted in CertExpress, our Finance team will review and approve your request so long as your resale certificate details are valid. This may take up to 5 business days.

You can monitor the status of your request at any time from the Wholesale policies page beneath the CertExpress Status heading.

Viewing the status of an exemption request on the Wholesale policies page.

- Accepted: Your certificate was reviewed, approved and you will receive a follow-up email!

- Processing: Your certificate is awaiting approval from our Finance team.

- Expired: Your certificate has expired. We require a valid certificate.

- Denied: Your certificate has been rejected and you should receive a follow-up email from us explaining what steps to take next.