Last modified: March 13, 2025

Account activity and balance report

Overview

This report is available to practitioner seller accounts (profit accounts) and can be downloaded from the Reports page after your first successful payout.

This handy report can be downloaded for any tax year to assist with general accounting, staff payouts, and tax filing.

What data does this report capture?

This report is a running balance of dispensary sales activity. Through this running total, Net Sales, Cost of Sales (a.k.a. Cost of goods sold, or COGS), and Net Income can be calculated.

Downloading the report

This report, and other financial reports, are only available after your first successful payout.

To download the account activity and balance report:

- Select your name or avatar to open the practitioner menu, then click Financial Reports. On mobile, select the menu ( ) , followed by your name or avatar, then tap Reports.

- Scroll to the Account Activity and Balance Report heading.

- Select a year.

- Click Excel to download a formatted .xslx file to your device. Or, select CSV for an unformatted comma-separated values file.

Activity summary

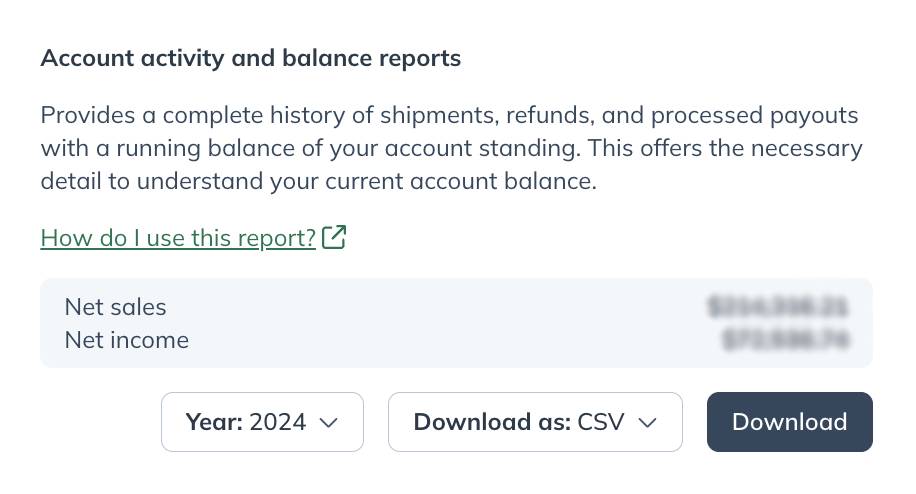

The account activity and balance report summary is a snapshot of your sales activity.

To view this activity summary, go to the Financial reports page and select a year.

Net income

Net income is calculated as Net sales (sum of sales_total column) less Cost of sales (sum of cogs_total column).

Net sales

Net sales are the sum of your gross sales minus returns, allowances, and discounts.

Cost of sales

Cost of sales represents product cost and fees earned by Fullscript associated with administering the transaction. Also referred to as cost of goods sold (COGS).

Transactions found in the report

Shipments

Shipment rows represent successful or canceled shipments. All order activity is appended to the report at the time of an order’s first shipped shipment (including all earnings). Canceled shipment rows will generate for any products removed from the order after the first shipment (i.e., backorder cancellations).

Payouts

Payout rows reflect successful payouts.

Payouts appear as a negative value in the total column to withdraw from the dispensary’s available balance.

Refunds

Refund rows are refunds that stem from product returns.

Refunds adjust the balance by negating appropriate columns: msrp_total, patient_discount (if applicable), sales_total, cogs_total, subtotal, and total.

Report column headings and descriptions

Descriptions of headings found in the account activity and balance report have been provided below to help navigate the report.

| Column headings | Description |

|---|---|

| transaction_number |

The shipment ID. (i.e., H95998906904) |

| transaction_type |

The row’s record type. i.e., payout, refund, or shipment. |

| transaction_status |

The transaction record’s status. i.e., amounts paid (payouts), shipped (orders), or received (refunds). |

| order_number |

Fullscript order number. (i.e., R111222333) |

| transaction_date |

The date the shipment shipped; the date the refund was received; the date the payout was paid. |

| msrp_total | Total MSRP (retail price) of the shipment. |

| sales_total |

Represents the total retail cost and is calculated as the msrp_total less the patient_discount. The sum of this column equals Net Sales. |

| patient_discount |

The total discount ($) the patient received on the order. |

| cogs_total |

The fee earned by Fullscript representing product cost and fees associated with administering the transaction. The sum of this column equals Cost of Sales (or cost of goods sold). |

| total |

Represents Net Earnings from the transaction and is calculated as the sales_total less cogs_total in the US report. Note: This is the ‘amount’ column in exports for previous years (2019 and earlier). |

| balance |

Running balance of funds available for payout. |

Additional columns – Canadian reporting only

Canadian reporting has additional columns to accommodate accounts that have opted-in to collect tax on their payouts.

| Column headings | Description |

|---|---|

|

subtotal (Canada only) |

Represents the order’s net earnings to be paid before HST and is calculated as sales_total less cogs_total. |

| hst (Canada only) |

HST paid (appended to payout) if the customer provided their business number to collect HST on payouts. |

| total |

Represents net earnings from the transaction and is calculated as sales_total less cogs_total plus hst in the CAN report. Note: This is the ‘amount’ column in exports for previous years (2019 and earlier). |

Report versioning (historical vs. current reports)

Current reports (2020 and later) have been updated to improve accuracy and general navigation.

Below is a summary of the improvements made to the current version (2020 and later) of the account activity and balance report:

- Refunds involving multiple products have been consolidated into a single row.

- Canceled shipment rows (i.e., backorder deletions) have been added to the report to offset the initial order balance paid at the time of the first shipped shipment.

- Transaction dates (i.e., payouts and refunds) in historical reports reference the day transactions were first created. They’re now recorded with the last updated date to reflect the payment/refund deposit date on customer bank statements more accurately.

- The ‘amount’ column has been replaced with a ‘total’ column — a more accurate term for the column representing total accumulated earnings to be paid.

- For consistency, maximum discounted orders now appear in the report.

- Gross Sales has been renamed to Net Sales, a more intuitive term given that this total is adjusted by returns.

- Order cancellations and deleted items before the first shipment are now excluded from the report. These deletions were previously known to inflate net income in error.

- Canada only: HST rows have been replaced with an ‘hst’ column to easily associate HST adjustments to shipments, cancellations, and refunds.